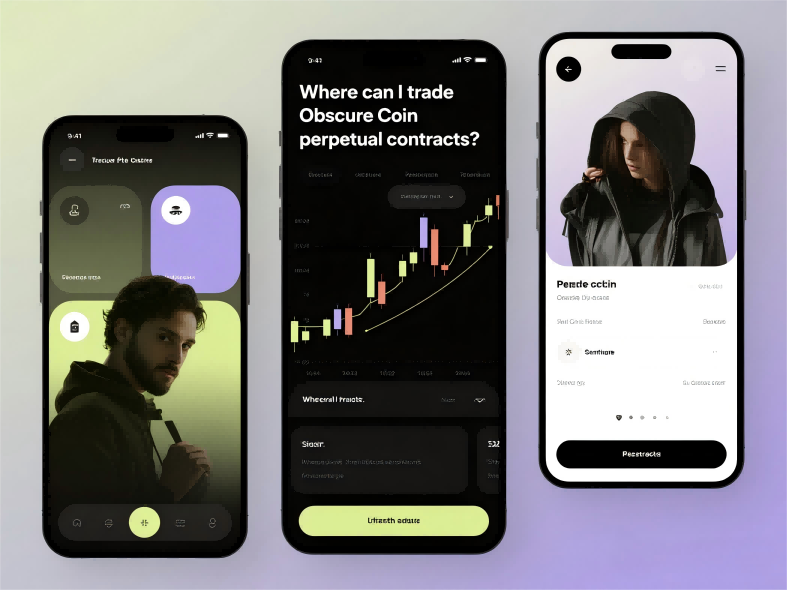

The crypto market never sleeps, and neither do the traders hunting for the next big opportunity. While everyone's watching Bitcoin and Ethereum, the real action often happens in obscure corners of the market—those tiny-cap coins that can deliver life-changing gains overnight. But here's the million-dollar question: Where can you actually trade perpetual contracts on these obscure coins?

Most major exchanges ignore these micro-cap assets, leaving traders scrambling to find platforms with enough liquidity to execute trades without getting destroyed by slippage. The right exchange can mean the difference between catching a 100x moonshot and watching helplessly as your dream trade evaporates in a pool of nonexistent liquidity.

Perpetual contracts offer unique advantages for trading obscure coins:

But trading these assets isn't for the faint of heart. Liquidity can vanish in seconds, funding rates swing wildly, and some exchanges have been known to delist coins mid-trade when volatility gets extreme.

PFD has built its reputation on listing coins long before they hit mainstream exchanges. Their perpetual contracts section includes assets you won't find anywhere else, with leverage up to 20x.

Real-world example: When PEPE first launched, PFD had perpetual contracts available days before Binance or Bybit listed it—early traders made fortunes.

Pros:

Cons:

While Bybit doesn't list quite as many obscure coins as KuCoin, their selection of smaller-cap perps includes better liquidity and tighter spreads. Their inverse contracts (denominated in BTC or ETH) are particularly useful for traders avoiding stablecoin exposure.

Pros:

Cons:

Gate.io flies under the radar but consistently lists obscure coins with perpetual contracts before they gain mainstream attention. Their liquidity isn't always the best, but for true early movers, it's often the only game in town.

Pros:

Cons:

While 20x-50x leverage sounds tempting, obscure coins can move 30% in minutes. A good rule of thumb:

Obscure coins often have extreme funding rates. Savvy traders will:

Exchanges frequently delist obscure perpetual contracts without warning. Protect yourself by:

Platforms like dYdX and GMX are bringing perpetual trading on-chain, offering:

But challenges remain:

Emerging platforms are using machine learning to:

As perpetual trading grows, regulators are taking notice. The coming years may see:

Obscure coin perpetuals offer unmatched profit potential, but they're not a casino—they're a high-stakes professional trading arena. The keys to success:

✅ Pick your exchange wisely (KuCoin for selection, Bybit for execution, Gate.io for earliest access)

✅ Manage risk like your life depends on it (because your trading account does)

✅ Stay ahead of the curve (new platforms and strategies emerge constantly)

"The biggest rewards hide in the most obscure markets—if you know where to look."

Remember: in the world of obscure coin perpetuals, the early bird gets the worm—but the careless trader gets liquidated. Trade smart, stay nimble, and may your next obscure coin trade be the one that changes everything.

Spot trading is straightforward: you buy an asset like Bitcoin, Tesla stock, or gold, and you profit if the price goes up

Read MoreTrading has always carried an air of possibility. The idea of turning a well-timed decision into a life-changing profit a

Read MoreStart your CFD trading

Your All in One Trading APP PFD