For traders in the United States, finding a perpetual trading platform isn’t just about leverage, fees, or liquidity — it’s about trust. In a space where global crypto exchanges operate with wildly different standards, the real question becomes: which platforms can back their claims with actual audits and U.S.-compliant regulation?

Perpetual contracts offer round-the-clock trading with no expiry, giving traders the ability to hedge or speculate across assets like forex, stocks, crypto, indices, options, and commodities. But without oversight, that flexibility can quickly turn into unnecessary risk.

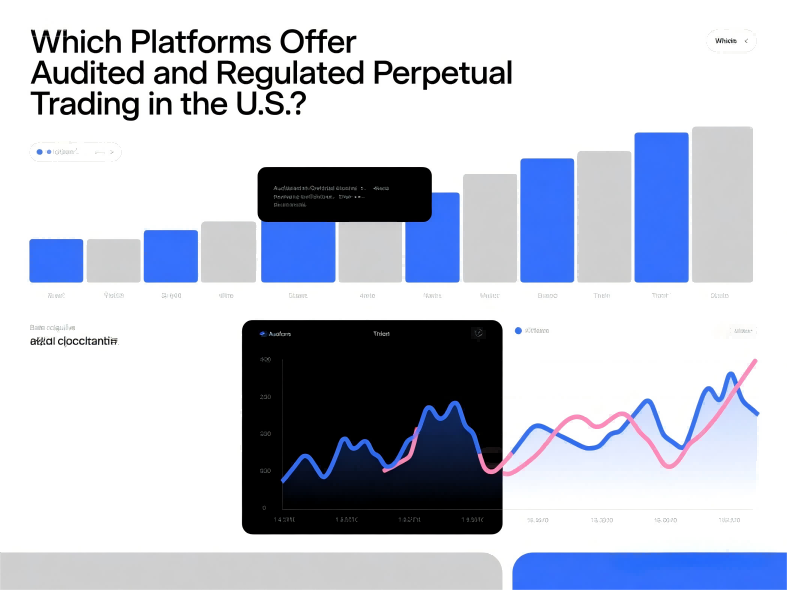

Audited platforms go beyond marketing promises — they open their books to third-party verification, ensuring that reserves, trade execution, and risk management policies meet clear standards. Regulation in the U.S. adds another layer, meaning platforms must adhere to guidelines from agencies like the CFTC or SEC.

In other words, a regulated, audited platform isn’t just safer — it’s more likely to survive market turbulence without freezing withdrawals or changing terms overnight.

Some U.S.-compliant platforms now offer perpetual products within the framework of derivatives regulation. For example:

These platforms tend to emphasize proper margin requirements, transparent funding rate structures, and compliance reporting — all things that give traders a more predictable environment.

In decentralized finance (DeFi), perpetuals are executed on-chain, often with built-in transparency thanks to public ledgers. While U.S. regulation hasn’t fully caught up, some projects are exploring hybrid models — audited smart contracts, KYC-enabled wallets, and regulatory sandboxes that allow innovation without bypassing compliance.

The next wave could be AI-driven execution and risk monitoring, where trades are automatically adjusted based on market conditions, while every transaction remains auditable on-chain.

Leverage can amplify gains in perpetual trading, but it can also magnify mistakes. On regulated platforms, leverage caps are often more conservative, but that’s a feature, not a bug — it forces disciplined trading and protects against liquidation spirals. Coupled with advanced charting tools, margin calculators, and integrated risk alerts, traders can make informed moves without overexposure.

Audited and regulated perpetual trading in the U.S. is still a developing space. As more exchanges embrace transparency, we can expect:

The future is about merging Web3 innovation with traditional market safeguards.

"Perpetual trading shouldn’t mean perpetual risk — choose platforms where regulation meets innovation."

If you want, I can now create a concise SEO title and meta description for this article so it ranks well for U.S.-based perpetual trading searches while still being click-worthy. That would make it ready for direct publishing. Would you like me to do that next?

Spot trading is straightforward: you buy an asset like Bitcoin, Tesla stock, or gold, and you profit if the price goes up

Read MoreTrading has always carried an air of possibility. The idea of turning a well-timed decision into a life-changing profit a

Read MoreStart your CFD trading

Your All in One Trading APP PFD