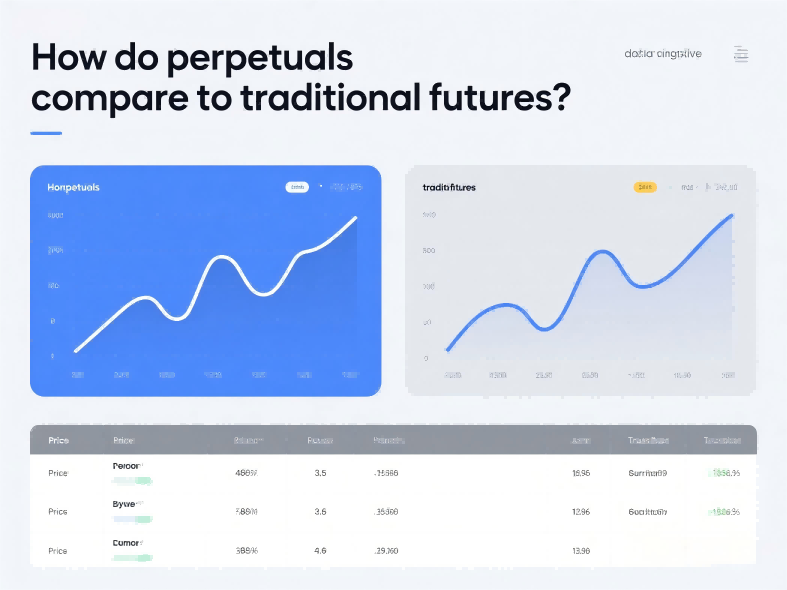

If you've spent any time in the markets — whether trading commodities, crypto, forex, or indices — you’ve probably come across the word “futures.” But now, a new term is everywhere: perpetual contracts. They’ve exploded in popularity thanks to 24/7 crypto markets and the rise of decentralized finance (DeFi). But what exactly sets them apart from traditional futures? And more importantly, which one works better for you in today’s fast-paced, tech-driven financial world?

Let’s dive into the real-world differences, risks, and rewards — without the jargon.

Traditional futures contracts come with a set expiration date. Whether you’re trading oil, wheat, or Bitcoin futures on the CME, there's always a “maturity” — a moment when the contract expires and settles, either in cash or physical delivery.

Perpetuals? There’s no expiration date. You can hold a position for minutes or months — as long as you manage your margin. That flexibility gives retail traders more control, especially in volatile crypto markets where long-term plays might not fit a fixed calendar.

Example: Imagine buying a December crude oil future on the CME — you’d have to roll it forward before it expires or let it settle. With a perpetual oil contract on a decentralized platform, you could ride that trend as long as the market moves in your favor.

Traditional futures are settled at expiration — often based on spot prices. This gives clarity to institutional traders and hedgers, especially in markets like agriculture or metals.

Perpetual contracts use a funding rate system to mimic spot prices in real-time. Depending on the difference between the perpetual price and spot price, traders either pay or receive funding every few hours. It’s like a tug-of-war that keeps prices aligned without needing expiry.

This funding mechanism can work for or against you — a key thing to watch for if you're planning to hold longer-term.

Trading traditional futures usually requires a brokerage account, KYC, and sometimes hefty capital requirements. Not to mention, they often close for the weekend.

Perpetuals — especially on decentralized platforms — are changing that. You can trade straight from a Web3 wallet, no middleman, 24/7, on assets ranging from crypto to forex to synthetic stocks and commodities.

It’s this always-on, borderless access that’s pulling a new generation of traders into the DeFi space.

Both types of contracts offer leverage — but perpetuals often push it further. It’s common to see up to 100x leverage on some platforms. That can amplify gains, but it also raises the liquidation risk dramatically.

Traditional futures typically cap leverage more conservatively, especially in regulated markets. That makes them potentially more stable — but less attractive to risk-tolerant, short-term traders.

Tip for both worlds: Use proper stop-loss strategies, track your liquidation price, and don’t let leverage seduce you into oversized positions.

Modern perpetual trading platforms are becoming full-blown ecosystems. With AI-driven trade assistants, on-chain analytics, and customizable dashboards, traders today have smarter tools than ever before.

Traditional futures platforms like Interactive Brokers or CME-backed terminals still offer rock-solid depth and historical data. But they don’t always match the flexibility and speed of newer Web3-native platforms — especially when it comes to integrating DeFi liquidity, NFT-collateralized margin, or wallet-native trading.

Charting tools, automated strategies, and copy trading features are also more accessible in the perpetual space, creating opportunities for even casual traders to get involved.

Decentralized perpetual platforms like dYdX, GMX, and Synthetix are pushing boundaries. You keep custody of your funds, trade 24/7, and avoid intermediaries. But that also means you’re responsible for your own keys, contract risks, and the protocol’s health.

Audits help, but nothing’s 100% bulletproof. Still, with smart contracts improving and insurance protocols emerging, DeFi futures trading is quickly becoming more trustworthy.

We’re heading into an era where AI-driven bots, on-chain risk control, and smart contract-based position management will dominate. The lines between traditional and perpetual trading are blurring fast — and multi-asset trading is at the center of it.

Whether you’re trading stocks, crypto, forex, indices, options, or commodities, perpetual contracts are offering faster settlement, better liquidity, and more flexibility than ever.

As regulation evolves and protocols grow more secure, perpetuals could easily become the default format for digital-native traders. Still, they’ll likely exist side-by-side with traditional futures for institutional hedging and long-cycle strategies.

“Perpetuals are built for the always-on trader. Traditional futures are made for structure and legacy. Know your style. Trade your edge.”

Both perpetual and traditional futures have their place. It’s not about choosing one over the other — it’s about understanding your risk appetite, time horizon, and trading goals.

Want weekend action, lower barriers to entry, and exposure to synthetic markets? Perpetuals might be your new home.

Need institutional-grade access, tight spreads on regulated assets, and clear settlement rules? Traditional futures still lead that domain.

Whatever you choose, equip yourself with the right tools, stay disciplined, and evolve with the market.

The future of futures isn’t one path — it’s multi-chain, multi-asset, and always moving. Are you ready to trade it?

Spot trading is straightforward: you buy an asset like Bitcoin, Tesla stock, or gold, and you profit if the price goes up

Read MoreTrading has always carried an air of possibility. The idea of turning a well-timed decision into a life-changing profit a

Read MoreStart your CFD trading

Your All in One Trading APP PFD