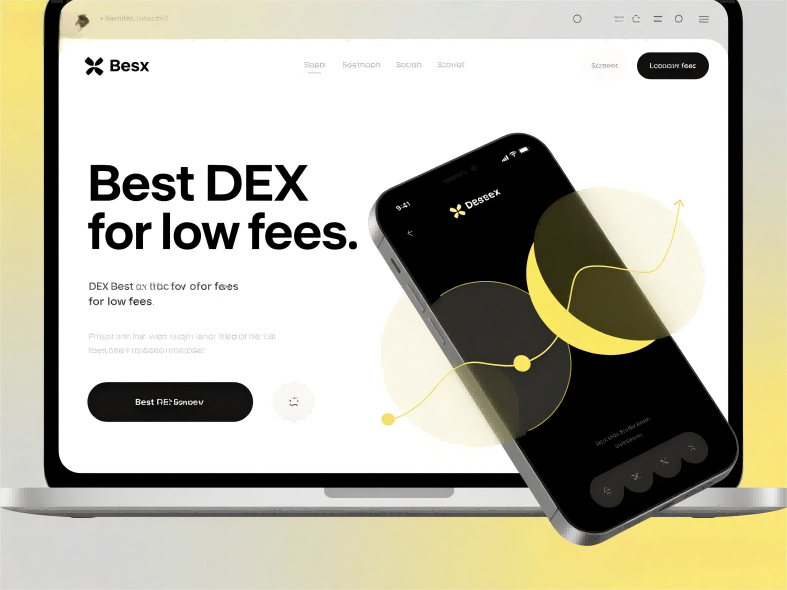

Let’s be real—nobody likes getting nickel-and-dimed by transaction fees. Whether you’re swapping $50 of Ethereum for that hot new altcoin or providing liquidity to earn passive income, high fees can turn a profitable trade into a losing one. That’s where decentralized exchanges (DEXs) come in, offering a way to trade crypto without middlemen taking a hefty cut. But not all DEXs are created equal. If you’re hunting for the best DEX for low fees, here’s what you need to know.

Picture this: You’ve done your research, found the next big project, and you’re ready to swap some stablecoins for it. But when you check the gas fees on Ethereum, it’s asking for $30 just to approve the transaction—before you even make the trade. Ouch.

This is why traders are flocking to DEXs with minimal fees. Unlike centralized exchanges (CEXs) that charge withdrawal fees, trading fees, and sometimes even hidden costs, the right DEX can save you serious money.

Uniswap is the OG of DEXs, but Ethereum’s mainnet fees can be brutal. The good news? Uniswap now supports Arbitrum, Optimism, and Polygon, where fees are often just pennies per swap. If you’re sticking with Ethereum, timing your trades during low-gas periods can help, but Layer 2 solutions are where Uniswap really shines for cost efficiency.

PancakeSwap dominates the BNB Chain with some of the lowest fees in crypto. Swaps typically cost less than $0.10, making it a favorite for small traders and DeFi degens alike. Plus, its farming and staking options let you earn while keeping costs minimal.

Built on Avalanche and expanding to Arbitrum, Trader Joe offers lightning-fast trades with fees under a dollar. Its "Liquidity Book" feature even lets you customize slippage and fee tiers, giving you more control over costs.

If you’re into leveraged trading, dYdX on StarkEx (Ethereum’s Layer 2) offers near-zero fees for perpetual contracts. It’s a game-changer for active traders tired of high CEX trading costs.

Finding the best DEX for low fees isn’t just about the cheapest option—it’s about balancing cost, speed, and liquidity. Whether you’re a casual swapper or a DeFi veteran, moving your trades to a low-fee DEX can mean more profits in your pocket and fewer regrets at checkout.

Spot trading is straightforward: you buy an asset like Bitcoin, Tesla stock, or gold, and you profit if the price goes up

Read MoreTrading has always carried an air of possibility. The idea of turning a well-timed decision into a life-changing profit a

Read MoreStart your CFD trading

Your All in One Trading APP PFD